Allowable Expenses

Allowable Expenses

Determining whether an expense is allowable or unallowable is the first step in assigning a cost to an award. If an expense is not allowable on an award, do not charge it to that award. You must charge it to an unrestricted funding source.

Overview:

All expenditures on a sponsored award must be monitored for allowability. Uniform Guidance, requires that a cost be:

- Necessary and reasonable – a prudent person would have purchased this item for the project and paid this price

- Allocable – the goods or services involved are chargeable or assignable in accordance with the relative benefits received by the project.

- Consistent – expenses must be treated consistently across like circumstances

- Conform to any limitations or exclusions set forth in Federal guidance.

- Adequately documented

In addition to complying with Federal Uniform Guidance, all award expenditures must also be in accordance with University policy, sponsor policy, award terms and conditions, and system policy. If an unallowable cost is present on sponsored award, the charge must be removed off the award as soon as possible. Thoroughly read the terms and conditions of the award agreement to pinpoint any additional restrictions on the award.

Order of Precedence

Sponsors may restrict allowability of costs in several ways:

- In the terms and conditions of the individual award

- In the terms and conditions of an individual funding program

- In agency grant guidelines, including federal research terms and conditions and agency-specific terms and conditions

- Uniform Guidance

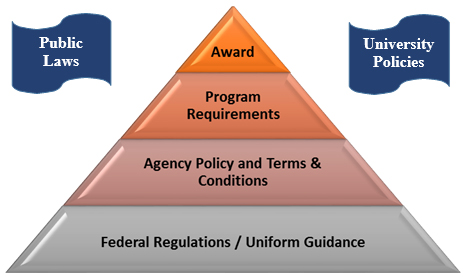

Regardless of the specific award requirements, all work must function within University Policy and Local, State, and Federal Law.

The figure above represents the order of precedence for deciphering allowability. Regulations become more specific to a particular award as you move from the base of the triangle to the top. Although all levels apply, when there is a conflict, the higher level regulations at the top of the triangle take precedence over lower levels.

For example, if an expense is permitted by Uniform Guidance, but prohibited by the Program Guidelines that apply to the award, then the expense is not allowable on the award. Similarly, if an expense is typically not permitted by Agency Rules, but is explicitly allowed in the Terms & Conditions of the award, then the expense is allowable on the award (e.g. a study on healthy eating may allow food costs, which are not typically allowed).

Direct Vs. Indirect Costs

Costs incurred for the same purpose in like circumstances must be treated consistently, as either direct or indirect costs.

- Direct Costs – Costs that can be identified specifically with a particular sponsored project or other internally or externally funded activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. For more information, see Uniform Guidance §200.413.

- Indirect Costs (Facilities and Administrative (F&A) costs) – Costs incurred for a common or joint purpose benefitting more than one cost objective, and not readily assignable to a particular sponsored project. Indirect (F&A) cost components include depreciation, interest, operations and maintenance, and library costs, as well as departmental, sponsored project, general, and student services administration costs, and other similar costs, that benefit many activities. For more information, see Uniform Guidance §200.414.

Generally Allowable Costs

For your reference, this section highlights common allowable and unallowable costs. This is not meant to be all-inclusive, and it’s essential to consult your award documents for specifics guidelines. Further guidance for can be found in the University Cost Principles.

- Salaries and Benefits for employees directly working on the sponsored award

- Supplies and Materials Necessary for the carrying out the award

- Travel associated with the project

- Equipment

- Consultants

- Subawards

- Laboratory Fees

- Patient Care Costs

- F&A (Indirect Costs)

Generally Unallowable Costs

- Advertising

- Administrative salary & fringe*

- Alcoholic Beverages

- Alumni activities

- Bad debt, losses, collection, legal costs

- Books/Reference materials*

- Commencement and convocation

- Conference/Meeting registration*

- Contingencies

- Copying/Duplicating*

- Donations and Contributions

- Entertainment

- Fines and Penalties

- First Class Air Travel

- Food (see Business Meals in Select Items of Cost)

- Fundraising and investment management

- General office supplies*

- Gifts/Prizes/Promotional Items

- Housing and personal living Costs

- Lobbying Costs

- Losses on Sponsored awards

- Memberships (see Memberships in Select Items of Cost)*

- Postage/Shipping*

- Selling and Marketing Costs

- Student Aid on federal research awards

- Subscriptions (see Subscriptions in Select Items of Cost)*

- Telephone Line Costs*

- Training and Education*

*This type of expense is often considered an indirect cost, thus, not charged as a direct cost without properly documenting and justifying the direct benefit to the award.

Responsibility for Compliance

Principal Investigators (PIs) and their departments are responsible for complying with the applicable sponsor requirements for sponsored projects and for the prudent management of all expenditures and actions affecting the award. Documentation for each expenditure or action affecting an award must reflect appropriate organizational reviews or approvals which should be made in advance of the action.

Resources

- Internal Training, Identifying Unallowable Costs

- Cost Principles Policy, Section 16

- Treatment of Select Items

- Federal Uniform Guidance 2 CFR 200: Subpart E – Cost Principles (200.400)

- HHS Uniform Guidance – 45 CFR Part 75 (CDC, HRSA, etc.):Subpart E – Cost Principles (75.400)

- NIH Grants Policy Statement: Section 8 Administrative Requirements

- NSF Proposal and Award Policies and Procedures Guidelines